The name of the crypto-token being traded here arises from the fact that it has no real value (literally worthless) and thus no future in the cryptocurrency market. The artificial inflation of value of the shitcoin is known as the pump phase while the selling of the now-expensive crypto-coin to naïve investors and bystanders is called the dump phase.

Our article here is going to tackle this topic by analyzing the anatomy of a particular P&D group that we studied in details. Come with us…

The Group

Every passing day new crypto-trading groups are coming up, with most of them being unscrupulous business people out to make a quick buck from naive investors. Often, most of these are actually outer rims of existing and already-established trading groups, i.e. a secondary layer whose main aim is dumping crypto-coins to uninformed investors

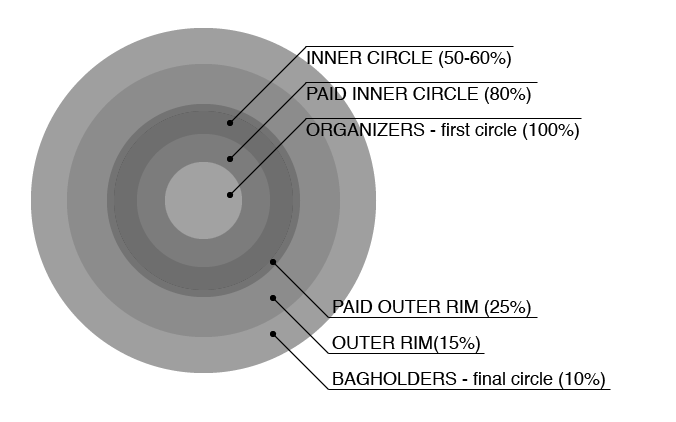

Participants in the core layer (see diagram) agree on the digital coin to target and pass that information to members of the outer rim. Often, even within the core layer itself there exist a number of levels.

For instance, those who had made the entry payment of between 1 to 10 BTC, generally receive the information about 5 to 6 seconds before it reaches others in the outer rims. That gives them some great deal of time to make their purchases at a lower cost. Other members join in a while later, with rims further away from the core finding out the coin that was picked only about 10 to 30 seconds later. This prompts them to go into hardcore crypto-buying.

Nowadays it is extremely difficult to locate quality core trading layers that are accepting new membership. And if you find one, joining it will be prohibitively expensive — typically 15 BTC and above — for most people. Generally, most groups new traders are joining today are 2nd- or 3rd-layer groups. It’s worth noting that the total number of successful trades you can make reduces the further your layer is from the P&D center.

Organizers of P&D groups almost always taste success in trading since they’re the ones making the decision regarding the coin to target next. Often, they buy it well in advance; sometimes even days prior to conceal their trail from traders in outer circles. By the very nature of this trading model, already the chance of success for the very next layer and others is diminished.

Another challenge is that although traders in layers beyond the core have paid to access trading information, a technical glitch can render them out of the train. Given that the information doesn’t take too much time to reach outer circles, if such a difficulty happens — for instance a split-second disconnection of the internet — things could fall apart quite easily.

The level of success diminishes as you move further away from the core. Looking at the graphs, you could easily tell the crypto-coin that is being pumped. Sometimes, the outer rims can also take advantage of such information to purchase before members of internal circles, thus beating them to better prices. This phenomenon keeps resolving till the outermost circles.

Phase #1: Announcing the Coin to Target

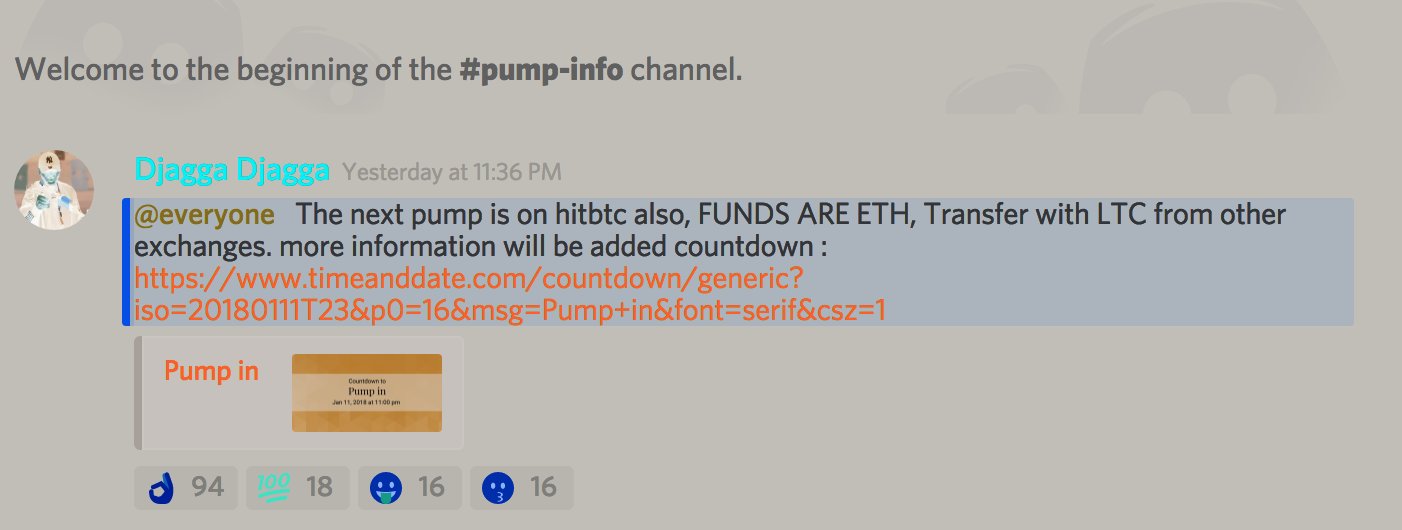

The frequency of pumps in a particular group depends on many factors, including the nature of the group itself. While some pump a number times per day, others do it once or twice per week and others even once every month. The group we studied is comparatively new in the market and, on average, pumps once per day.

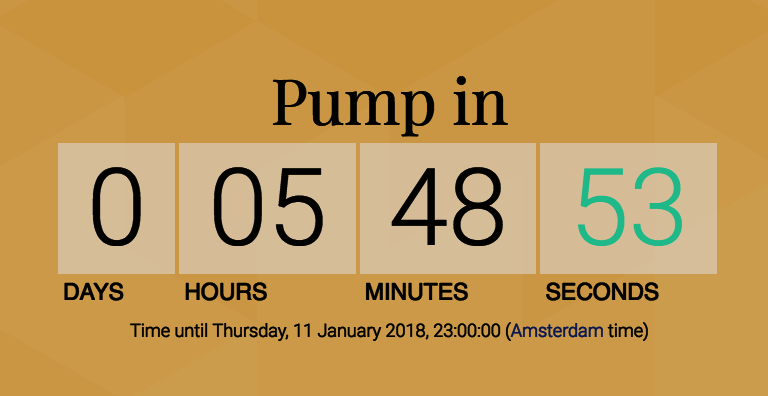

Phase one involves the announcement of the time when the pump will be happening, and the picking of the crypto-exchange platform on which it will be done. Often, the organizers will send out a link with a clock countdown that makes it easy for traders from different time zones to follow the process seamlessly. Crypto-tokens targeted by P&D organizers are hardly listed on reputable cryptocurrency exchanges. Some of the platforms they mostly use include HitBTC, CoinExchange, Cryptopia and other smaller exchanges similar to these ones.

NOTE: Apart from the organizers of P&D schemes, no one else knows about the coin to be targeted in the pumping.

Phase #2: Countdown and Preparations

Once the countdown has started, participating traders will get their accounts ready by loading them up with money to trade. Often, this amount is only sufficient to enable them click “max” in their UIs in a bid to hasten the buys at market value.

Time and speed being very critical here, generally any other programs running in the trader’s computer will be turned off. The internet connectivity is also freed up by ensuring any streaming or torrents are also stopped to speed up response times. All these measures are aimed at avoiding the creation of bagholders.

The wittiest and most experienced traders often employ trading bots, i.e. scripts used for programmatic buying that don’t require a browser to function. Once they input the symbol of the targeted coin, the bot then takes over, simultaneously also setting up the desired limit sell order (typically 150 to 200% of the buying price). All this is done in a split-second with the help of the bot.

Phase #3: Pumping the Crypto-Coin

Once the coin is picked, the P&D administrators then purchase enough of it to leverage on its subsequent price spike. However, they make sure not to buy so much of the coin as to start moving the price themselves because that would make them lose followers in case other traders accuse them of pre-pumping.

Normally, such a move would be executed during the dying stages of a P&D group when most members have already lost trust in the organizers and only the most naive traders remain — i.e. those who can’t recognize a pre-pump from normal pumping — as the very last ploy to milk the last bits of unscrupulous profits from the remaining participants.

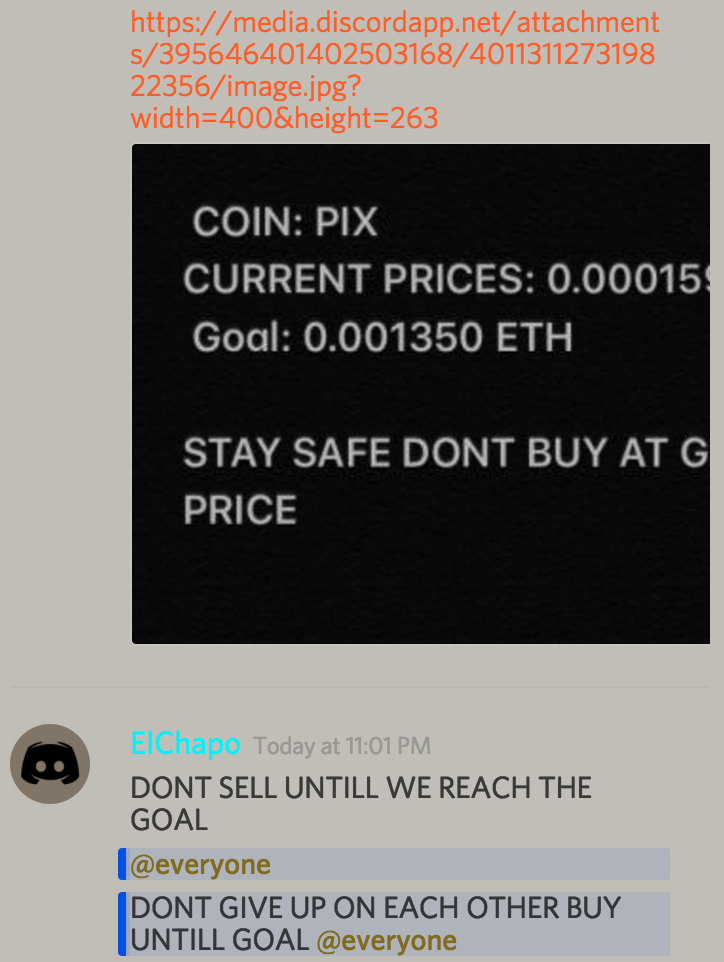

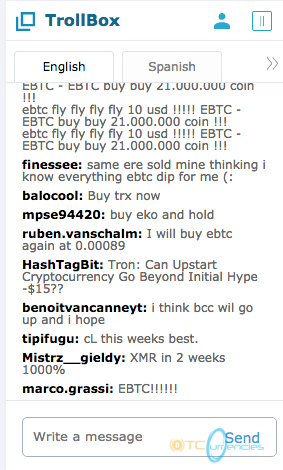

Only after their bags are full will the organizers release the information regarding the coin being traded to the rest of the membership. While some rush to employ bots, others just go manual. But by the end of this phase, the intention is to have everybody in the group loaded up on the same crypto-coin to inflate its price. All those who have completed a buy then move into the hype phase, i.e. the step where all social media chat channels are consistently spammed with information about the “viability” of this particular coin. Everybody is urged to make a purchase, including bystanders and anybody else they can reach with the fake hype.

Phase 4: Dumping the Coin

The main aim here is to trick innocent and unknowing bystanders to purchase into the crypto-coin. Its “rapid rise” — which is, by this time, visible on the graph — is used to convince them.

With a rapid sell-off being orchestrated by the participants who had bought earlier, the dumping phase leads to the reduction of the coin’s price to its initial price value, or even lower sometimes. In very rare cases, actually the pumping phase can permanently increase the price of a coin by 10 to 15%, depending on which coin is being used.

Professional Bagholders

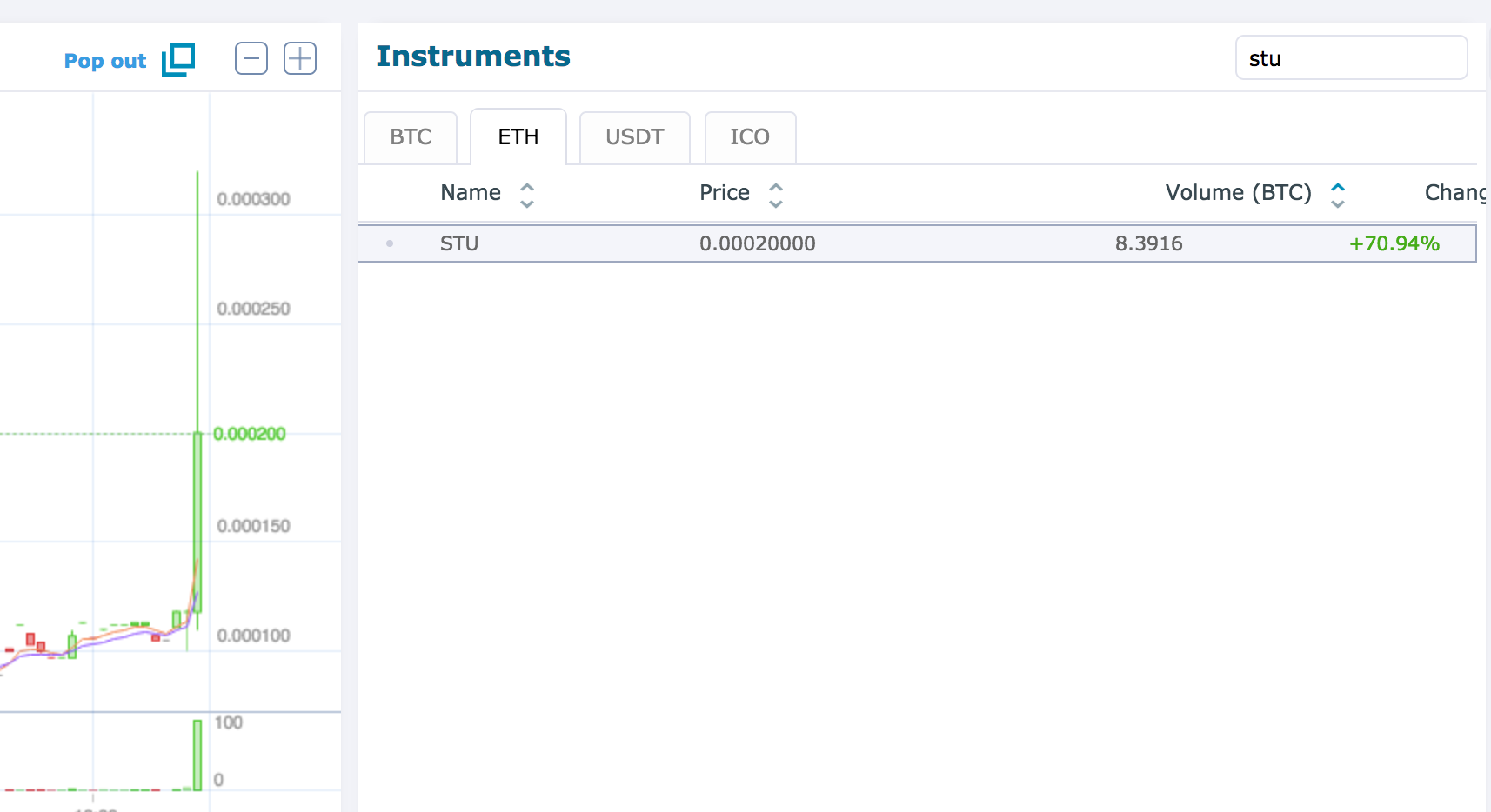

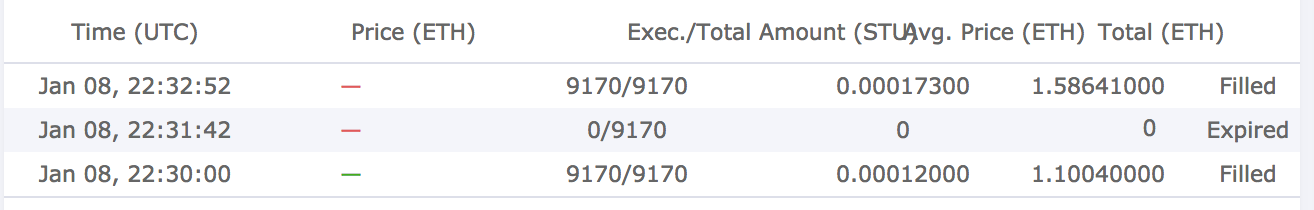

The process whereby the admins of a P&D group buy units of a particular coin before informing anybody else is what we call a pre-pump. For instance, in the group we studied, although the OAX coin had been announced to have a pump start time of 23:00, the graph below reveals that there was a pre-pump of about 20 minutes:

This enabled them to begin dumping units of the coin on their group’s participants immediately the announced pump time kicked off at 23:00. In this particular case, it was easy for the organizers to start moving the market by themselves since the coin only had a gross trading volume valued at 2 Eth on the HitBTC platform, meaning that even half an ether was enough to move the needle.

Most traders simply aren’t aware that during the pumping phase of a P&D group, the admins are orchestrating their own pump in the group membership itself so as to get the participants to purchase from them.

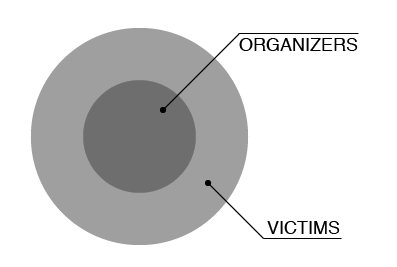

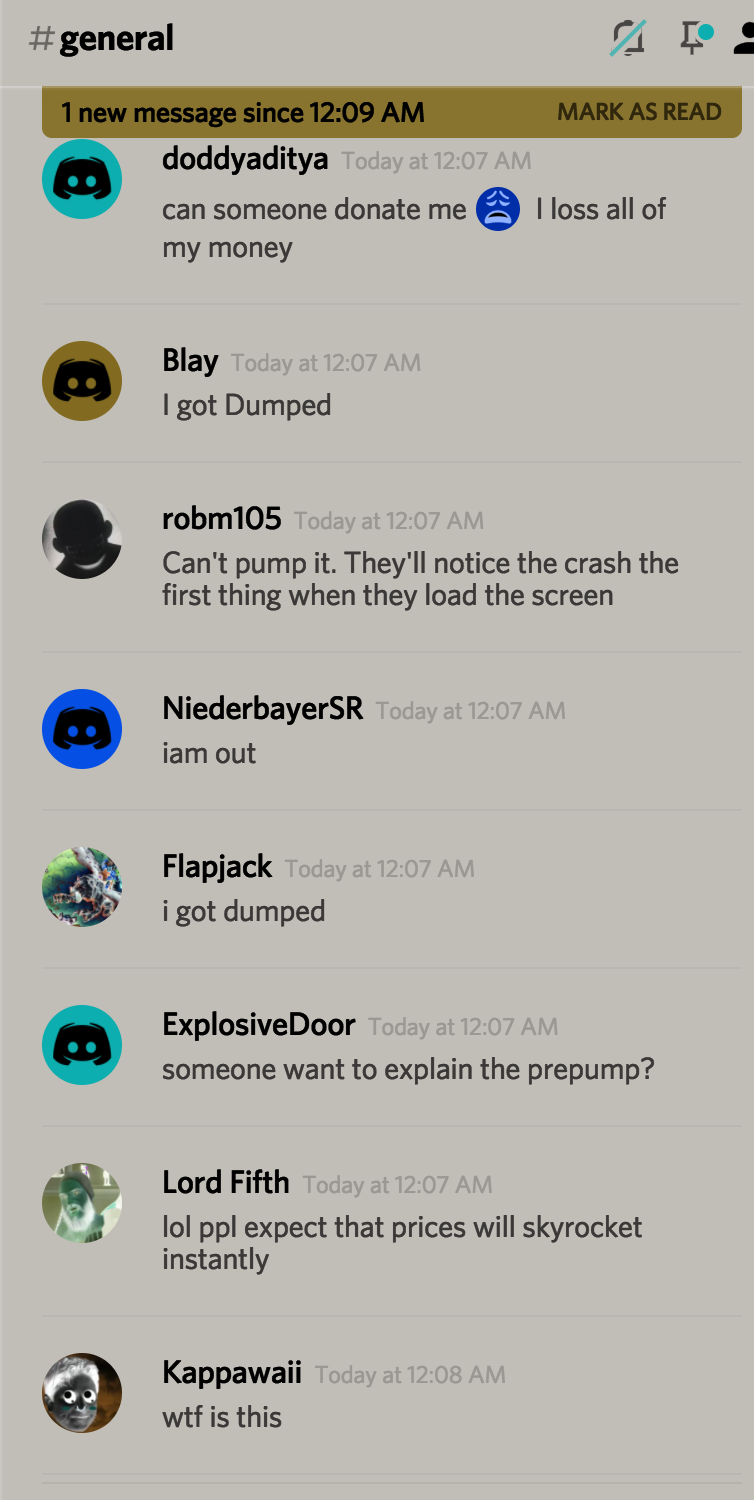

If a participant is lucky enough to sell the coin forward for something more than they bought, then they will naturally have some good reviews regarding the group. This is crucial in convincing new members to join. As for those that make losses, they will usually exit the group with little to zero negative feedback. Mostly, they will only complain about their failures and beg for favors, eventually leaving without being aware of anything fishy going on (see diagrams below).

Such members are referred to as professional bagholders since they come into the market wanting to make a quick buck, and often with funds they can’t afford to lose — zero research, zero effort, zero anlysis, zero thinking! Quite unfortunately for them, they won’t even take time to watch the first 3, 4 or 5 pumps to even learn what the group’s trading looks like.

Most of the P&D groups you will find people inviting you to are of this nature. They are fraudulous schemes designed to expressly portray the 1st pump as a successful and legit crypto-trading process so as to raise your interest. Once you join, future pumps will only be used to milk you and other participants dry. It is quite easy to create a new group; if you aren’t the admin or organizer, then you’re easily expendable to the creators.

Other Kinds of P&D Groups

Apart from the method we have discussed here, there exist other P&D types, with celeb endorsements /pumps being among the most popular ones. With hundreds of thousands or even millions of followers and fans on social media, celebs make good professional bagholder factories for P&D scheme creators. A good example is John McAfee whos has over 500,000 Twitter followers. This is how it works:

– P&D organizers choose a particular little-known coin and purchase lots of it;

– They then contact a celebrity like McAfee with the idea and pay him 25 BTC (currently his known fee);

– McAfee also purchases a number of units of the coin, before then rigorously promoting it to his followers. This is where the pump starts;

– Both McAfee and the P&D creators then dump the coin on his followers.

For the organizers, paying 25 BTC to McAfee can only be worth it if their potential profits exceed the expenses. This is the reason why such a scheme is normally arranged for long-term pumps such as Verge or bigger crypto-coins like Stellar or SiaCoin. The market cap here is enough to avoid a complete obliteration by purchase and sell orders from McAfee and the P&D organizers. Though extremely risky, such schemes can also be quite profitable for their creators.

Conclusion

If P&D schemes were conducted in the traditional investment sector, they would be illegal. But because the cryptocurrency market isn’t regulated yet, they are still being used by cunning organizers to make loads of cash quickly.

Opinions regarding P&Ds vary greatly, with those who lose money or fail to apply them properly usually labeling them as immoral or even criminal ventures. As for their creators and others who make money out of them, they consider them a great way to get rid of dumb money out of the crypto market. Still, there are those that consider them an awareness mechanism regarding the bitcoin bubble.

But from an objective viewpoint, such schemes are as immoral as betting or lottery ads are. Everything that involves money has both risks and benefits. Without sufficient research on technical investments and patience (HODL investment), as well as a good thought-out contact (P&D), you can’t make profit.

DISCLAIMER: btcurrencies doesn’t engage in P&D trading schemes. Ours is only a watch-only role. Primarily, we are long-term analysts and technical investors. Our participation in the studied group was only for research and information gathering purposes.