New Startups are raising hundreds of millions in only few minutes, that literally only have a whitepaper.

Now from the outside, it might seem like the holy grail of raising capital but think again.

ICO’s are not about raising capital.

ICO’s is about creating network effects and adding value to the ecosystem. = + net utility.

Network effect plays into more than just value of revenue and token. Network effects goes into the multiplier effect.

Network effect = More users, more habits, connections with other networks (API), brand leverage, momentum = Scaling

Not everyone can do an ICO…

A simple three step check list for you to use.

#1 What is your Token Utility?

Your Token that you are creating MUST provide a utility in your ecosystem, and increase network effect. Your token must be integral to the business model of your startup. Without a utility of your token, you can not do an ICO.

Ask yourself this questions. If you take away your token does your business fall apart? If the answer is no, then you don’t need a token. There are only a few cases that make sense to tokenize.

Majority of companies will not and do not need a token

There is term called, Token Velocity

I first heard of this from Kyle Samani

Token velocity – will people hold onto the asset, or will they sell it immediately?

To summarize what Token Velocity is.

It comes down to more outputs than inputs.

The token is being only used as a liquidation vehicle not a vehicle of value.

People don’t want to hold the Token if offers zero value at all.

Example: A Little know fact in the ICO space.

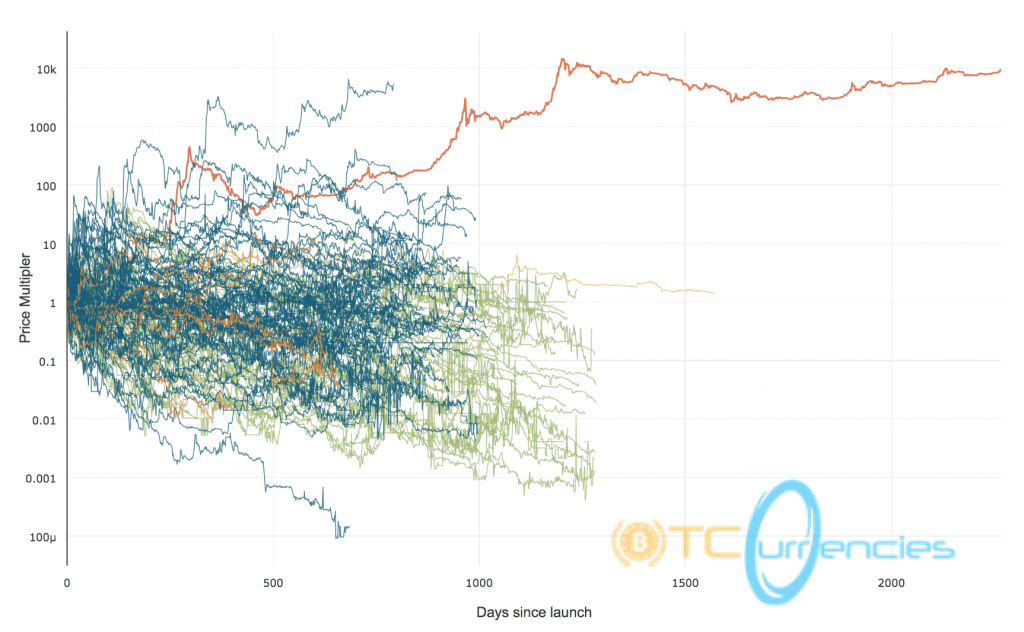

Majority of people ONLY buy tokens to make more Bitcoin or Ether

Hence the velocity increase!

“It seems that alt-coins are best left for trading due to their volatility, but very risky as holds. This may change in the years ahead, but for now, out of 700+ coins in my database I would say less than 5 have a shot of doing something interesting. It reminds me of early stage startup investing actually.”

This is why most ICO’s are doomed from the start

They are raising money with a token that has no value.

People literally just giving money away to nothing. It’s down right scary.

#2. Cryptoeconomics

Your token in the ecosystem must have proper crypto economic’s models and consensus models. This ensures the security and usability of your token to be valid. (MOST SKIP THIS STEP)

This step requires enormous amounts of due diligence from the brightest minds out there. There are only a few in the world who understand this.

There are two pillars of cryptoeconomics as the name itself suggests:

Cryptography. Economics.

Or as Ethereum research Vlad Zamfir states:

“A formal discipline that studies protocols that govern the production, distribution, and consumption of goods and services in a decentralized digital economy. Cryptoeconomics is a practical science that focuses on the design and characterization of these protocols.”

And as of today, there are probably only a handful of people in the world that knows this.

Crypto like: Bitcoin, Etheruem, Monero, Zcash have teams of the brightest people in the space and spend countless, time, days and years perfecting the cryptoeconomic models.

So, before you go off and spend your hard earned money on all the crazy ICO’s out there.

Just keep in mind that cryptoeconomics is the lifeblood of cryptocurrencies and tokens.

And be warned that 99% of all ICO’s do not and will not invest their time in this.

Because once again… It’s really…really… difficult to do!

…And this is one of the many reasons why I don’t really invest in ICO’s (Except for 2) because the majority of new Startups in this space do not incorporate cryptoeconomics.

#3 Security

If you do raise money, if you are one of the few that actually makes sense to ICO, then your first priority is the security of your token for your customers.

At this stage, you become a red target for hackers to attack you and trust me they will. Every week people are getting hacked and millions are stolen.

Take this into consideration.

More than 30,000 people have fallen prey to ethereum-related cyber crime, losing an average of $7,500 each, with ICOs amassing about $1.6 billion in proceeds in 2017, Chainalysis estimates.

“Phishing scams have helped push up criminal losses to about $225 million in 2017 so far, according to Chain analysis, a New York-based firm that analyses transactions and provides anti-money laundering software. In such scams, investors are tricked into sending money to Internet addresses pretending to be funding sites for digital token offerings related to the ethereum blockchain technology.”

Questions to ask yourself.

- Where are you storing your private keys?

- How are you protecting your wallets?

- How are you protecting your customer’s tokens on your ecosystem?

These are serious questions that need answering.

Now, I have only touched on three points.

There are much more.

I am not here to shit on ICO’s.

I love them! I think they are revolutionary…

I might do one, one day too!

But, I am here to inform you that, ICO’s are much more than fundraising, they are about building networks and new mathematically ecosystems

I know we will see an evolution of ICO’s going forward

From Crypto equity ICO’S

To rev share ICO’S

…And many different models

But as of today companies that are raising money with a token that has no utility is a formula for disaster.

So be warned!