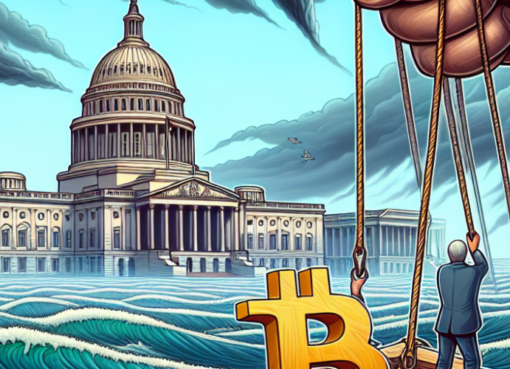

In a decisive move that is rattling the cryptocurrency markets, the U.S. government has introduced a new set of regulatory measures aimed at increasing transparency and security within the digital currency space. Announced earlier this week, these regulations are expected to dramatically alter how cryptocurrencies are bought, sold, and stored in the United States.

The U.S. Department of the Treasury, in collaboration with the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), outlined the regulatory framework which mandates all cryptocurrency exchanges operating in the U.S. to adopt stringent anti-money laundering (AML) procedures and enhanced user identity verification processes. The agencies believe these steps are critical in curbing the illicit use of digital currencies while protecting legitimate investors.

Key elements of the new regulations include:

– Mandatory registration of all cryptocurrency exchanges with the SEC.

– Enhanced scrutiny of large transactions, specifically those exceeding $10,000.

– Requirement for exchanges to report suspicious activities to the authorities in a timely manner.

– Guidelines for the secure storage of digital assets, compelling exchanges to bolster cybersecurity measures.

These sweeping reforms come in the wake of several high-profile cryptocurrency thefts and the increasing use of digital currencies in illegal online activities. The Treasury Secretary remarked during the press conference, “As cryptocurrencies become more mainstream, it is imperative that we evolve our regulatory frameworks to ensure market stability and protect consumers.”

Market reaction to the news was swift and significant. Bitcoin, Ethereum, and other major cryptocurrencies saw a dip in their values, reflecting investor uncertainty about the impact of these regulations. Cryptocurrency exchanges, on their part, have been cautious in their response. While some have welcomed the clarity brought about by the new rules, others fear that stringent regulations might stifle innovation and hinder the growth of the still-nascent industry.

Experts in the field have largely applauded the government’s balanced approach to nurturing the cryptocurrency market while aiming to weed out bad actors. “These regulations are a step in the right direction,” stated a leading cryptocurrency analyst. “They provide much-needed infrastructure to the industry, which will help in gaining investor confidence and ensuring a safer market environment.”

However, some critics argue that increased regulatory pressures could push investors towards offshore exchanges, potentially leading to a loss of revenue for the U.S. market. They advocate for a more measured approach that supports the growth of this dynamic sector.

The implications of these new regulations are extensive. Cryptocurrency exchanges are now under pressure to quickly comply with the new standards or face potential fines and other legal actions. Additionally, the regulations are set to influence how cryptocurrencies are perceived by institutional investors, potentially leading to increased mainstream adoption.

As the implementation date of the new regulations nears, all eyes will be on the U.S. cryptocurrency market. The changes could also prompt other nations to reconsider their regulatory stance on digital currencies, potentially leading to a globally coordinated approach towards cryptocurrency regulation.

For U.S. cryptocurrency users and investors, these developments are a reminder of the evolving nature of the market. The new rules could lead to more secure and stable investment opportunities, albeit at the cost of increased scrutiny and decreased privacy. As the landscape adjusts to these changes, the true impact of the regulations on the U.S. cryptocurrency market will unfold in the months to come.

As the world grapples with these shifts, the next few months will be crucial in determining whether these regulatory interventions will indeed pave the way for a safer and more robust digital currency environment or if they will dampen the innovative spirit that has characterized the cryptocurrency movement so far.