New York, NY — In an unexpected rally, Bitcoin has shattered expectations by surging past the $50,000 mark for the first time in six months, signaling a robust recovery in the cryptocurrency market. This milestone, reached early Thursday morning, has not only revitalized investor interest but also sparked discussions on the long-term viability of digital currencies.

The immediate catalyst behind this surge appears to be the influx of positive institutional news coupled with significant advancements in network enhancements. Analysts are pinpointing several key developments that could be driving this bullish trend, including the recent adoption of Bitcoin as a legal tender in two more countries and the announcement of several large U.S. banks exploring crypto trading services.

Institutional Adoption and Technological Enhancements

Experts suggest that the recent legislative moves in Norway and New Zealand, where Bitcoin has been granted legal tender status, are pivotal. These decisions are expected to propel further adoption in other nations, as governments observe the integration of Bitcoin into the mainstream financial framework of these countries.

On the technological front, the successful implementation of the Taproot upgrade last November has enhanced the blockchain’s efficiency and privacy. Such advancements make Bitcoin an increasingly attractive option not just for investors but also for enterprises looking for secure, decentralized solutions.

Financial Giants Taking the Leap

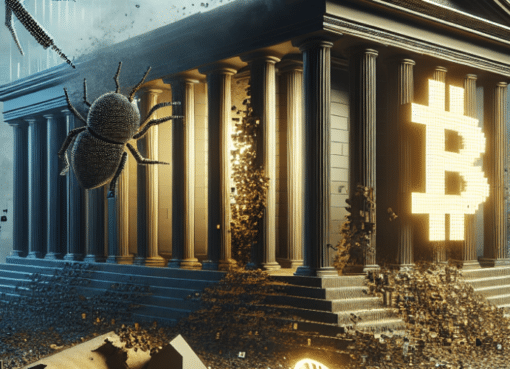

Adding to the positive sentiment are reports that several Wall American banks, previously hesitant about diving into the crypto pool, are now setting up dedicated crypto trading desks. The involvement of these institutional players is perceived as an endorsement of cryptocurrency’s potential, providing a safety net of credibility and stability that was lacking before.

“Seeing renowned institutions coming on board is a strong signal to the market that cryptocurrencies like Bitcoin are here to stay,” explained Caitlin Long, CEO of digital bank Avanti Financial. “It reassures retail and institutional investors alike, potentially leading to a more stabilized market.”

Market Response and Investor Sentiment

The market response was swift, with Bitcoin climbing over 15% in just a few days. As of Thursday morning, Bitcoin was trading at around $53,000, a significant jump from last month’s low of $41,000. The total market cap of Bitcoin has now exceeded $1 trillion, a clear indicator of its growing influence.

Retail investors, who had been cautious amid the regulatory uncertainties and market volatility, are now re-entering the market. Social media and trading forums are abuzz with optimistic projections, with many pointing to the historical patterns of Bitcoin’s recoveries.

“Every time Bitcoin has dipped, it has rebounded to new heights. This isn’t just a recovery; it’s setting the stage for an unprecedented bull run,” noted Alex Saunders, a well-known crypto influencer and analyst.

Looking Forward

While the current surge in Bitcoin prices is a source of celebration for crypto enthusiasts, some analysts advise caution. The cryptocurrency market is notoriously volatile, and while the fundamentals are strengthening, external factors such as regulatory changes and macroeconomic shifts could still pose risks.

However, the overall market sentiment remains bullish. With increased institutional support and continuous advancements in blockchain technology, Bitcoin seems poised for further growth.

This resurgence is not just about price; it’s about the growing recognition of Bitcoin and similar cryptocurrencies as more than speculative assets. Their potential to transform financial systems globally is now beginning to be realized, ushering in what many hope will be a new era for cryptocurrency.

[Note: As an AI, I can’t create images. Please consider sourcing or creating an image that aligns with the theme of Bitcoin’s surge past $50,000, perhaps illustrating its growth trajectory or the elements driving its rise.]

—

This article offers an in-depth look at the recent developments in the Bitcoin market, providing insights into the factors contributing to its latest surge and the broader implications for the cryptocurrency landscape. Keep revisiting this space for updates on this evolving story.