In a recent development that has stirred the cryptocurrency community, one of the world’s leading cryptocurrency exchanges, CryptoGlobalX (a fictional entity), is facing severe regulatory scrutiny from several national regulators as it expands its services to include cryptocurrency derivatives and lending. This news comes as a significant blow to the platform, which has been a staple in the crypto trading world, offering a range of services from spot trading to complex financial products.

CryptoGlobalX announced the launch of its cryptocurrency derivatives segment early last week, aiming to provide its users with options and futures trading capabilities, alongside its new lending service. However, the move has caught the attention of financial regulatory bodies in the United States, European Union, and Asia, raising concerns about the compliance of these new services with existing financial regulations.

The regulatory bodies are scrutinizing CryptoGlobalX for potential violations of securities laws, given the nature of cryptocurrency derivatives which often fall under more stringent regulation due to their complexity and risk factors. Concerns have also been raised regarding the transparency of the platform’s lending service, especially in light of recent turmoil in the crypto lending market.

The Securities and Exchange Commission (SEC) of the United States, along with the European Securities and Markets Authority (ESMA) and several Asian financial regulators, have issued preliminary notices to CryptoGlobalX. These notices question the adequacy of consumer protection measures and the robustness of the platform’s operational resilience.

A spokesperson from CryptoGlobalX responded to these concerns, stating, “We are committed to full compliance with regulatory standards and are actively engaging with authorities to address their concerns. Our priority remains to offer secure and compliant services to our users.”

This development underscores a growing trend of regulatory challenges facing cryptocurrency platforms as they innovate and expand their offerings. Regulatory bodies worldwide have been tightening their stance on cryptocurrencies, aiming to curb illegal activities and protect investors amidst volatile market conditions.

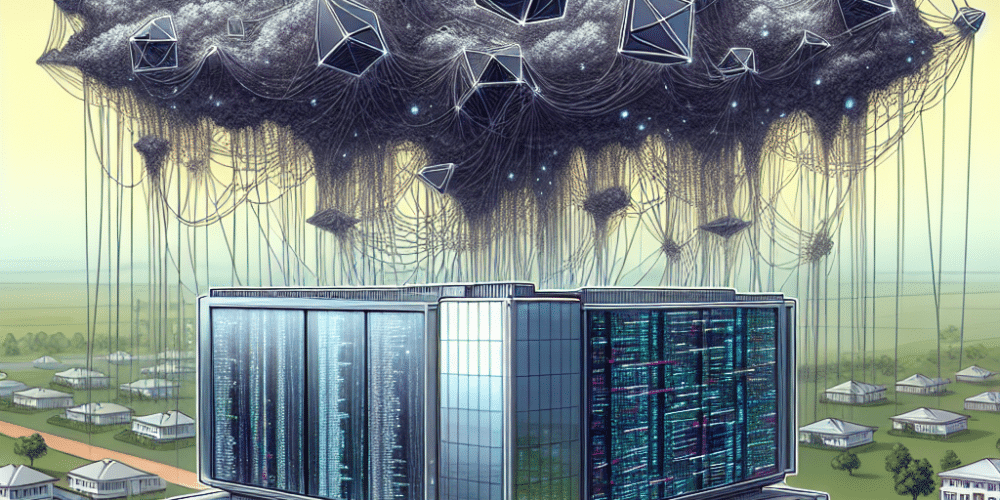

The situation with CryptoGlobalX serves as a critical reminder of the fine balance that must be struck in the crypto industry between innovation and compliance. As platforms vie to offer new and beneficial products to a global audience, they must navigate the complex web of national and international regulations that govern their operations.

For investors and users of CryptoGlobalX, the regulatory concerns introduce a level of uncertainty about the future usability of the platform’s new services. Users are advised to stay informed about the evolving regulatory landscape and consider the implications it may have on their trading activities and investment choices.

Moreover, the broader cryptocurrency market is closely watching this situation unfold, as its outcome could set important precedents for how similar cases are handled by regulatory authorities in the future. A shift towards stricter regulatory oversight could potentially slow down the pace of innovation in the crypto sector but might also lead to more stable and trustworthy market conditions.

Financial analysts are also weighing in on the issue, suggesting that CryptoGlobalX’s proactive engagement with regulators could mitigate potential negative impacts. They recommend that other crypto platforms take note and possibly reevaluate their operational strategies to ensure compliance and transparency in their own expansions.

As the crypto industry continues to evolve, the intersection of technology, finance, and law becomes increasingly complicated. Platforms like CryptoGlobalX must carefully manage their growth strategies while ensuring that they do not run afoul of the laws designed to protect the market and its participants.

This breaking news not only impacts CryptoGlobalX and its users but also sends ripples across the cryptocurrency landscape, signaling a possibly transformative era of enhanced regulatory oversight.

Investors and regulatory bodies alike will be watching closely to see how this situation develops, and whether it will prompt further regulatory challenges or encourage more stringent compliance strategies among other players in the crypto space. Indeed, the future of cryptocurrency innovation may well depend on the industry’s ability to align with the evolving regulatory framework.