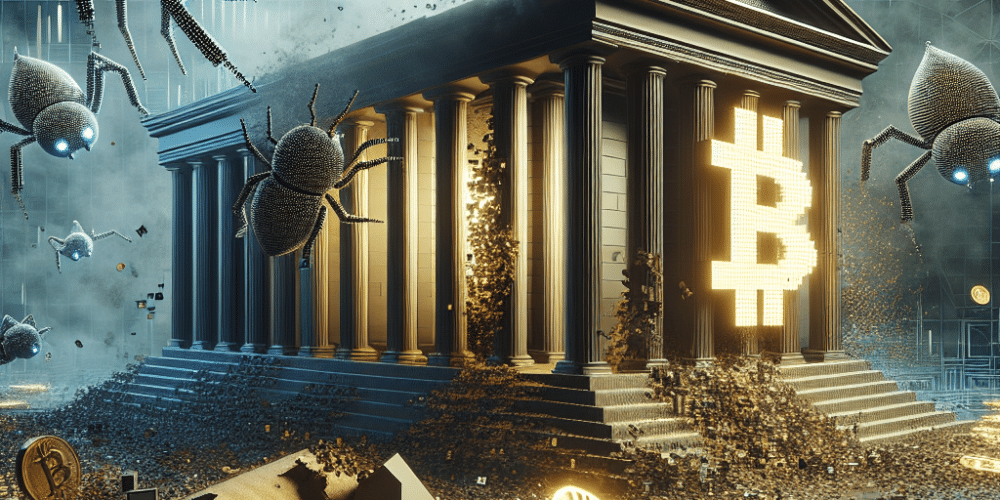

In a shocking development that has rippled through the cryptocurrency community, one of the world’s largest cryptocurrency exchanges has reportedly fallen victim to a sophisticated cyberattack, resulting in the theft of millions of dollars worth of Bitcoin. The breach, which was first detected early yesterday morning, has prompted a swift response from both the exchange and international cybersecurity experts.

The unnamed exchange, which ranks among the top five globally in terms of daily trading volume, disclosed that an estimated $200 million worth of Bitcoin was siphoned off by hackers. This event marks one of the most significant security lapses in the digital currency sphere this year, highlighting ongoing vulnerabilities within crypto exchanges.

The Heist Details

According to initial reports, the attackers exploited a vulnerability in the exchange’s digital infrastructure, primarily targeting its hot wallets. Hot wallets are online tools that allow cryptocurrency owners to store and manage their digital assets. Unlike cold wallets, which are not connected to the internet and are thus more secure, hot wallets are susceptible to online threats.

The breach was first spotted by the exchange’s internal security systems, which detected unusual withdrawal patterns that deviated significantly from typical user behavior. Upon discovering the irregularities, the exchange immediately halted all withdrawals and deposits to minimize further damage and commenced a comprehensive security audit.

Immediate Reactions and Measures

The CEO of the affected exchange made a public announcement detailing the steps being taken in response to the cyberattack. “We are working closely with cybersecurity specialists and law enforcement to address the current situation,” he stated. “Our priority is to safeguard our users’ assets, and we have already implemented enhanced security measures to prevent such incidents in the future.”

Furthermore, the exchange has promised to reimburse all affected users. Plans have been made to use the exchange’s own reserves to cover the stolen funds, a move that has been met with mixed reactions from the cryptocurrency community.

Broader Implications for the Cryptocurrency Market

This incident has stirred widespread concern regarding the overall security of digital assets. Investors and cryptocurrency enthusiasts are increasingly anxious about the potential risks associated with trading and storing cryptocurrencies.

“The recurring theme of security breaches in crypto exchanges is a stark reminder of the technical and operational risks that still plague this industry,” explained a blockchain security expert. “Each breach provides crucial lessons on the weaknesses of current systems and the urgent need for upgraded protection measures.”

Market Response

Following the news of the hack, the cryptocurrency market experienced a brief but intense period of volatility. Bitcoin’s price dipped by approximately 4% in the hours following the announcement, although it has since shown signs of partial recovery.

Looking Forward

This latest breach is expected to prompt further regulatory scrutiny of cryptocurrency exchanges worldwide. Authorities are likely to push for stricter security protocols and perhaps even official certifications for platforms handling digital assets.

In response to growing concerns, several leading exchanges have already announced plans to increase their security investments, focusing on advanced solutions such as multi-factor authentication, end-to-end encryption, and more rigorous monitoring systems.

Conclusion

While the immediate financial impact of the theft is substantial, the long-term effects on the credibility and reliability of cryptocurrency platforms might prove even more significant. As the digital currency landscape continues to evolve, the emphasis on security has never been more critical. Both users and platforms must collaborate to foster a safer crypto environment, or risk undermining the trust and utility of these revolutionary technologies.

This incident serves as another critical reminder of the challenges facing the burgeoning cryptocurrency market. The balance between accessibility and security continues to be a pivotal issue, and how it is managed will likely shape the future trajectory of the digital finance world.